1) Tax relief can give your retirement savings a big boost

The government rewards people saving for retirement by offering valuable tax relief on any contributions you make into your pension, within your personal annual allowance.

So, for example, if you pay £80 into your pension, the taxman tops this up to £100. If you’re a higher or additional rate taxpayer, you can claim back up to an additional 20% or 25% through your self-assessment tax return. That means if you’re a higher rate taxpayer and you pay in £80, you’ll get £20 tax relief added automatically, and you can claim back an extra £20 via your tax return, rising to £25 if you’re an additional rate taxpayer.

Remember that tax rules can and do change over time, so tax relief might not be around for ever.

2) Taking too much out of your pension too quickly could land you with a big tax bill

Changes to pension rules in 2015 mean that if you want to take your whole pension out at once, you can. But doing so could result in a hefty tax bill.

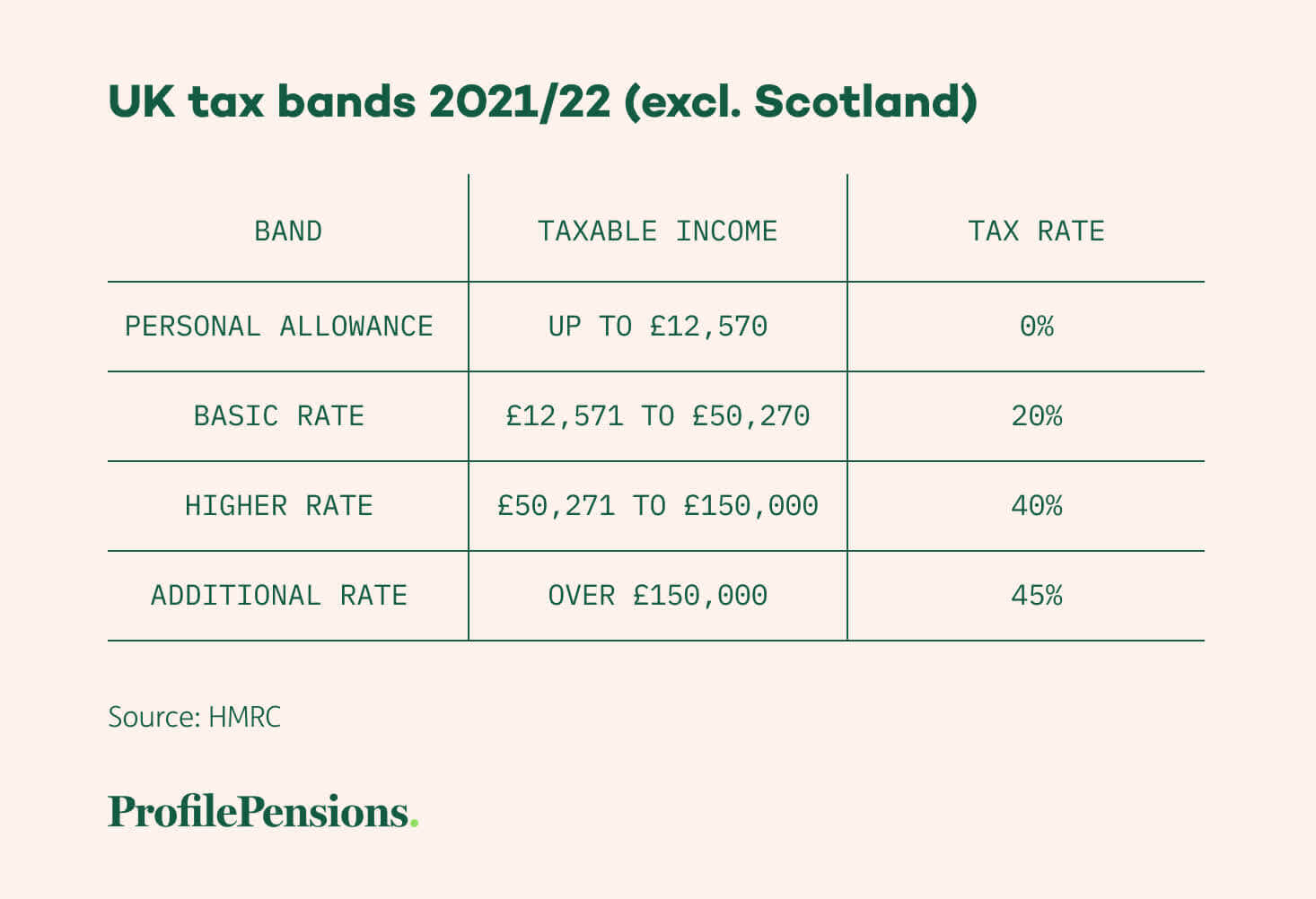

That’s because if you did take your pension as a lump sum, only the first 25% would be tax-free. The remaining 75% of your pension savings is taxed at your ‘marginal rate’ of income tax. This is the tax band you fall into once any income you have, including any cash withdrawn from your pension is factored in. You’ll pay tax if your income is above the Personal Allowance, which is the amount everyone is entitled to receive free of tax in any tax year. Below are the tax bands for the 2021/22 tax year:

When your money is invested in a pension it’s tax free which enables the money to grow without any tax being paid, however your pension is taxable when you start to withdraw it. Taking a large amount at once could push you into a higher tax band, meaning you might have to pay tax at the higher rate of 40% or even the additional rate of 45%, rather than at the basic 20% rate. It also means you risk running out of money too soon.

3) You can reduce the amount of tax you pay by taking out your pension gradually

One way to take money from your pension gradually is through ‘flexi-access drawdown’. This enables you to take an income from your pension as and when you need it, whilst leaving the rest of your retirement savings invested. For example, you might have a pension pot of £50,000 and opt to take £1,000 a month from it. In this case, each month 25% or £250 would be tax-free, and the remaining £750 would be taxable.

Alternatively, you might decide to use your pension to buy an annuity, or income for life. Again, you can take 25% tax-free first, then use the remainder to buy an annuity. The income from your annuity is taxable.

Find out more about accessing your pension.

4) You might be able to pass on your pension free of tax when you die

If you’ve chosen to take an income from your pension via flexi-access drawdown and you die before the age of 75, your pension can be paid to a nominated beneficiary free of tax.

If you die after the age of 75, your beneficiaries will have to pay income tax which will apply on any money they take out of your pension. Basic rate taxpayers will pay income tax at 20%, or 40% if they are higher rate taxpayers, or 45% if they are additional rate taxpayers.

If you have a final salary or defined benefit pension, check your scheme’s rules to see what’s payable to your dependants when you die. Often, the amount they can receive will be based on a percentage of your pension entitlement. This will always be taxable, regardless of what age you die. More on pensions after the death of a loved one in this guide.

5) Allowances matter

There are two important allowances pension savers should be aware of.

The first is the Annual Allowance. This is the maximum amount you can pay into your pension this tax year and receive tax relief on. In the current 2021/22 tax year, the Annual Allowance is £40,000.

Once you start taking money out of your pension and you’ve already received the maximum tax-free amount, you’ll only be able to pay in and get tax relief on up to £4,000 a year.

If you pay in more than the Annual Allowance, the taxman will hit you with a tax charge on the amount you’ve gone over it by. This is to stop people getting extra tax relief by taking money out of their pension and then paying it back in.

The second allowance is known as the Lifetime Allowance, and only really applies to those with big pension pots. This limits the amount you can draw from your pension without paying extra tax. This tax year (2018/19) the Lifetime Allowance is £1.03m and next tax year (2019/20) it will rise to £1.055m.

The value of investments, and the income derived from them, can go down as well as up and you can get back less than you originally invested. This article does not constitute personal advice. Prevailing tax rates and reliefs are dependent on your individual circumstances and are subject to change. Please note we do not provide tax advice.